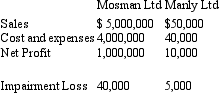

Consider the following information:

You are an accountant for both firms and would like to determine whether the impairment loss is material or not. Which of the following statement(s) is/are correct?

1. The impairment loss for both firms is material.

2. The impairment loss for Manly Ltd is material.

3. The impairment loss for Mosman Ltd is material.

4. The impairment loss for both firms is immaterial.

5. None of the given answers.

Definitions:

Written Off

The accounting action of declaring that an asset has become worthless or a debt is uncollectible and recognizing it as a loss.

Bad Debt Expense

An expense reported on the income statement, representing the estimated amount of receivables that a company does not expect to collect.

Allowance Method

An accounting technique used to estimate and account for potential uncollected debts or credit losses in financial statements.

Uncollectible Receivables

Financial debts owed to a company that are deemed uncollectible and written off as a loss.

Q5: AASB 136 requires that:<br>A) If a non-current

Q6: The IASB and US FASB are jointly

Q7: Which of the following statements about the

Q11: What is the correct electronic configuration for

Q15: A 20-ton truck collides with a 1500-lb

Q19: Which of the following statements is correct

Q27: You are seated in a bus and

Q40: Pursuant to Corporate Law Economic Reform Program

Q44: Where the value of revalued non-current assets

Q50: The predictions of PAT formulated by Watts