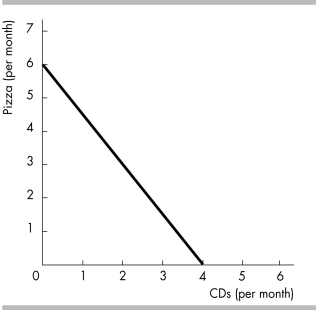

-According to the budget line in the above figure, which of the following combinations is unaffordable?

Definitions:

Risk-Free Rate

The theoretical return on an investment with no risk of financial loss, typically represented by the yield on government bonds from stable countries.

Perfectly Negatively Correlated

Describes two variables that move in opposite directions; if one increases, the other decreases.

Global Minimum Variance Portfolio

An investment portfolio that is designed to have the lowest possible risk (variance) for the expected return, part of modern portfolio theory.

Standard Deviation

A measure of the dispersion or variability in a set of data points, indicating the degree of risk or volatility.

Q8: For the monopoly shown in the figure

Q45: Describe the mechanism by which PrP is

Q55: Sulfonamides<br>A) are antimetabolic drugs.<br>B) were the first

Q57: The figure above shows Ronald's budget line.

Q67: The _ are a group of Gram-positive

Q131: If you considered steak and lobster to

Q146: If marginal utility is positive but diminishing,

Q270: Which of the following factors is NOT

Q286: If the relative price of pizza in

Q294: In the above figure, as Brendan's income