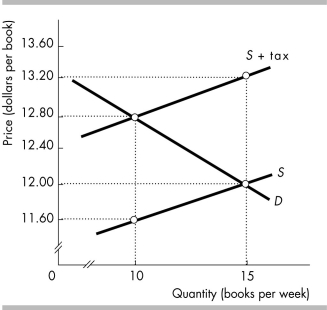

-The figure shows the market for books before and after a sales tax is introduced. The tax on books is ________ a book, buyers pay ________ of tax per book, and the government's tax revenue is ________ a week.

Definitions:

Tax Rate

The fraction of earnings or profits on which the government imposes taxes on individuals or corporations.

Coupon Rate

The annual interest rate paid by a bond issuer to the bondholders, usually expressed as a percentage of the bond's face value.

Semi-Annually

A frequency of twice a year, often used in the context of payment or performance evaluation periods.

Tax Shield

The reduction in income taxes that results from taking an allowable deduction from taxable income, such as mortgage interest, depreciation, or charitable donations.

Q51: Suppose that the country of Pacifica imposes

Q85: Assume that your state government has placed

Q138: Tariffs and import quotas both decrease the

Q173: The table above gives the demand and

Q217: In 1920 a constitutional amendment was passed

Q261: The supply curve for CDs shows the<br>A)

Q278: Suppose that apartments rent for $1,300 a

Q322: At Revolution Doughnuts in Fort Collins, Colorado,

Q381: Marginal cost is the<br>A) extra benefit that

Q402: One reason why soda companies are so