-Draw an average total cost curve, an average variable cost, and a marginal cost curve all on the same graph. Make sure to correctly label the axes. What relationship must exist between the marginal cost curve and the average total cost and average variable cost curves?

Definitions:

Foreign Taxes Paid

This represents taxes paid to foreign governments on income earned outside of the taxpayer’s country of residence, often creditable against domestic taxes in the taxpayer’s home country to avoid double taxation.

Deferred Tax Liability

An accounting term that refers to a tax due in the future for income that has already been recognized in the financial statements.

Effective Tax Rate

The average rate at which an individual or a corporation is taxed, calculated by dividing the total amount of taxes paid by the taxable income.

Temporary Difference

A difference that arises between the tax base of an asset or liability and its carrying amount in the financial statements, which will result in taxable or deductible amounts in future years.

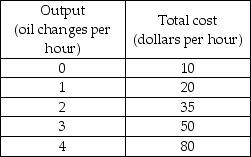

Q11: The table above shows the short-run product

Q29: The table above shows three production methods

Q32: What is the principal-agent problem as applied

Q47: In the personal computer (PC) market in

Q69: The output at which average product is

Q93: Labor costs $20 per worker and capital

Q176: Which of the following is a reason

Q211: If the ATC curve has a positive

Q352: In the above figure, the minimum efficient

Q428: What do economists mean when they say