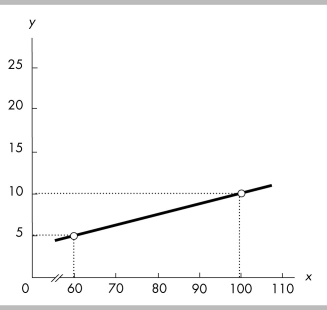

-The slope of the line in the above figure is

Definitions:

GAAP

Generally Accepted Accounting Principles (GAAP) are a set of accounting standards and principles designed to ensure consistency in financial reporting.

Repetitive Basis

A method or process that is regularly repeated in a consistent manner over time, often used to describe routine transactions or operations.

Deferred Charge

An expenditure paid for in one accounting period but reported as an asset because it will provide benefits in future periods.

Sales Tax

A tax imposed by governments on the sale of goods and services, collected by the retailer at the point of sale.

Q8: To increase efficiency,<br>A) taxes can be used

Q40: The only proper way to estimate the

Q52: Tax analysts and authorities believe that in

Q54: Among the G7 nations, the U.S. has

Q55: What are the desired characteristics for a

Q58: Systematic risk:<br>A) is the standard deviation of

Q82: Which of the following was NOT identified

Q135: Which of the following questions is NOT

Q170: If Quick Auto Service increases the size

Q369: From 8 P.M. to 10 P.M.., Susan