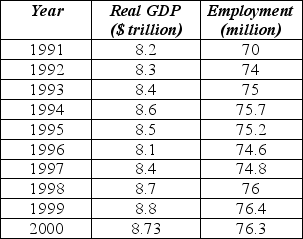

Table 5-1 shows data on real GDP and employment for a particular country from the year 1991 to 2000. Use the table to answer questions .

Table 5-1

-Refer to Table 5-1. A complete business cycle:

Definitions:

Tax Rate

The percentage at which an individual or corporation is taxed, which can vary depending on income level, type of tax, or jurisdiction.

Deferred Tax

A tax obligation that a company owes in the future due to timing differences between its taxable income and its accounting earnings.

Accrued Expenses

Expenses that have been incurred but not yet paid or recorded, representing liabilities for services or goods received.

Tax Deductible

Expenses that can be subtracted from gross income to reduce the amount of income subject to tax, thereby lowering the tax liability.

Q17: (Exhibit: Supply and Demand in Agriculture) If

Q30: Which of the following equations is correct?<br>A)

Q53: The equality between GDP and GDI in

Q84: Economic growth can be modeled as<br>I. an

Q97: The Affordable Health Care Act of 2010:<br>A)

Q174: An increase in consumer income will lead

Q177: (Exhibit: The Market for Chocolate-Covered Peanuts.) A

Q190: Given the events listed below that take

Q208: (Exhibit: The Market for Chocolate-Covered Peanuts) If

Q209: (Exhibit: Demand and Supply-Determinants) The exhibit shows