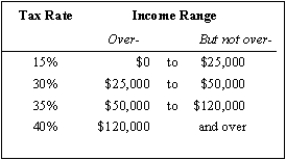

Exhibit 14-1

-Refer to Exhibit 14-1. If an individual is earning $38,500 in taxable income, that individual will be able to keep how much of one more dollar earned?

Definitions:

Applied Manufacturing Overhead

Applied Manufacturing Overhead refers to the estimated overhead costs assigned to individual products based on a predetermined rate and actual activity levels.

Overhead

The indirect costs of running a business that are not directly associated with the production of goods or services, such as administrative expenses and rent.

Underapplied

A situation where the allocated or budgeted costs are less than the actual costs incurred, typically in the context of manufacturing overhead.

Overapplied

A situation where the allocated overhead costs exceed the actual overhead costs incurred.

Q5: The stock of physical capital in the

Q15: The 1914 law aimed at preventing monopolies

Q26: There is more controversy among economists about

Q94: Which of the following are tradeoffs in

Q101: Fast Food, Inc. views marketing as the

Q109: In the United States, the top quintile

Q146: For the most part, the same people

Q147: Tradable permits work well in the case

Q152: Regulation of a natural monopoly firm would

Q171: Suppose a coupon of $15 is paid