Essay

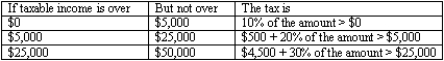

Consider the following personal income tax schedule for a taxpayer who is not married (single).

Definitions:

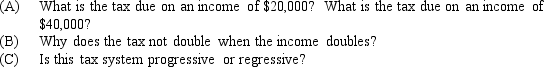

Related Questions

Q24: The diagram that provides a picture of

Q41: Marginal productivity theory indicates that those with

Q46: If the substitution effect is stronger than

Q58: For a mandated benefit to decrease total

Q86: Explain how people can eliminate externalities through

Q122: Consider the following income tax schedule for

Q137: The median voter is the one who<br>A)

Q144: Some risk is inherent in a market

Q148: If the interest rate at which a

Q165: Which of the following asset markets offers