Match the following characteristics with the appropriate model of firm behavior, and explain how efficient each firms is in the long run.

Definitions:

Real Rate

The interest rate that has been adjusted for inflation, reflecting the true return of an investment.

Annual Coupon

refers to the fixed interest payment that a bond issuer agrees to pay to the bondholder once every year until the bond's maturity date.

Zero-Coupon Bond

A bond that is issued at a discount to its face value but pays no interest; the investor's return is the difference between the purchase price and the face value at maturity.

Par Value

The face value of a bond or stock, representing the amount that the issuer agrees to pay at maturity or the nominal value assigned to a share of stock for accounting purposes.

Q20: A firm that shuts down earns an

Q42: Marginal product and marginal cost are not

Q47: A monopoly maximizes profit by<br>A) producing at

Q48: Explain what happens to the average total

Q53: The main purpose of antitrust law is

Q57: Deregulation is the<br>A) increase in antitrust policy

Q86: When regulators become captives of industry, firms

Q98: One of the most famous price-fixing cases

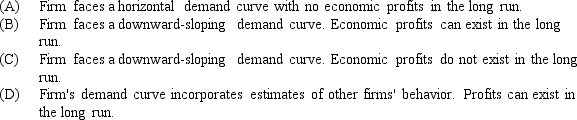

Q113: If a monopolistically competitive firm is in

Q136: A capital expansion causes average total costs