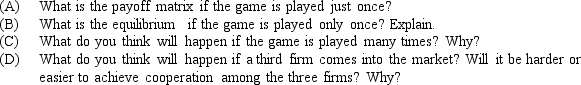

Suppose two small-town video stores, store A and store B, compete. The two stores collude and agree to share the market equally. If neither store cheats on the agreement, each store will make $2,500 a day in economic profits. If only one store cheats, the cheater will increase its economic profits to $4,000 and the store that abides by the agreement will incur an economic loss of $1,000. If both firms cheat, they both will earn zero economic profits. Neither store has any way of policing the actions of the other.

Definitions:

Interperiod Tax Allocation

An accounting technique that aims to match tax expenses with the revenues for the period in which they were earned, regardless of when taxes are paid.

Taxable Income

The portion of an individual's or corporation's income that is subject to taxation by governmental authorities.

Book Income

Book income refers to the amount of income reported by a company in its financial statements according to accounting principles, before any adjustments for tax purposes.

Deferred Tax Liabilities

Future tax payments a company is obligated to pay the government, arising due to temporary differences between its taxable income and its accounting earnings.

Q15: Refer to Exhibit 10-10. Calculate the deadweight

Q49: List three reasons for the rise and

Q54: In the short run, the profits for

Q75: When a firm's average total cost curve

Q87: Wages are returns to individuals owning a

Q98: One of the most famous price-fixing cases

Q100: Specialized magazines that give product reviews on

Q133: The demand curve for the labor market

Q141: The Teamsters' (truck drivers) union is a(n)

Q169: Refer to Exhibit 13-2. The MRP curve