Use the following information to answer the next fifteen questions.

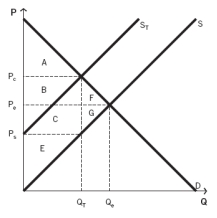

The following graph depicts a market where a tax has been imposed. Pₑ was the equilibrium price before the tax was imposed, and Qₑ was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers.

-Which areas represent consumer surplus before the tax is imposed?

Definitions:

Purchased

Purchased refers to items or services that have been bought or acquired by payment in various contexts, including inventory, assets, or services for a business.

Straight-Line Method

An accounting method of depreciation where an equal amount of an asset's cost is allocated as an expense each year over its useful life.

Salvage Value

The estimated value at sale of an asset following its period of utility.

Book Value

The net value of an asset as recorded on the balance sheet, calculated as the original cost minus accumulated depreciation or amortization.

Q5: Refer to the accompanying table.The price elasticity

Q11: If Firm A is making zero economic

Q13: Lauren is the owner of a bakery

Q18: Economists assume that the cost of _

Q25: Lauren owns a bakery.She currently bakes around

Q36: From the accompanying table,we would expect that,for

Q58: The deadweight loss from a tax is

Q126: Which of the following is both a

Q129: If a store sells a good at

Q143: When production of a good creates an