Use the following information to answer the next fifteen questions.

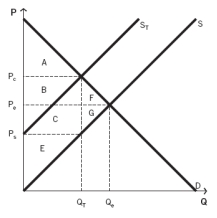

The following graph depicts a market where a tax has been imposed. Pₑ was the equilibrium price before the tax was imposed, and Qₑ was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers.

-Which areas represent producer surplus before the tax is imposed?

Definitions:

Commission-Only

Describes a compensation structure where an employee or agent is paid solely based on the commission from the sales they generate.

Commission

A service charge assessed by a broker or agent for facilitating a transaction, typically a percentage of the transaction's total value.

Merchandise

Goods or items that are available for purchase in retail, including a wide range of products from clothing to electronics.

Commission Rates

The percentage or fixed payment associated with a commission, determined by the terms of the agreement.

Q7: Which of the following would cause the

Q9: According to the figure below,at the price

Q12: The costs of a market activity paid

Q16: The government allocates three allowances to each

Q33: In a market where supply and demand

Q52: Explain a situation in which,when holding costs

Q73: What would happen to the equilibrium price

Q95: By reducing trade barriers,the government:<br>A)reduces imports.<br>B)increases the

Q96: Negative externalities have _ for third parties.<br>A)internal

Q138: The per-unit dollar amount of a tax