Use the following information to answer the next fifteen questions.

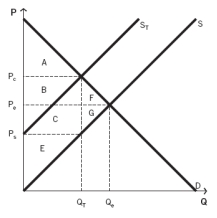

The following graph depicts a market where a tax has been imposed. Pₑ was the equilibrium price before the tax was imposed, and Qₑ was the equilibrium quantity. After the tax, PC is the price that consumers pay, and PS is the price that producers receive. QT units are sold after the tax is imposed. NOTE: The areas B and C are rectangles that are divided by the supply curve ST. Include both sections of those rectangles when choosing your answers.

-What is the total amount of producer and consumer surplus (i.e.,social welfare) in this market after the tax is imposed?

Definitions:

Tax Rate

The portion of income or profits the government takes as tax from a person or company.

Unlevered Value

Unlevered value is the value of a company or investment assuming it has no debt financing, focusing solely on its equity value.

Tax Rate

The proportion of financial income that is taxed from either a person or a corporate body.

Unlevered Rate

A financial metric that measures the return on investment without considering the impact of financial leverage.

Q27: Your neighbor is an avid gardener who

Q51: This firm would shut down in the

Q53: In 1993,the government increased the tax on

Q59: Which of the following conditions will result

Q66: Steve owns a bike store.If he decided

Q68: You share a house with two other

Q74: Which of the following conditions will result

Q77: If the cross-price elasticity of demand between

Q117: Assume that the price of rubber increased

Q131: Costs that have been incurred as a