Use the following information to answer the following questions.

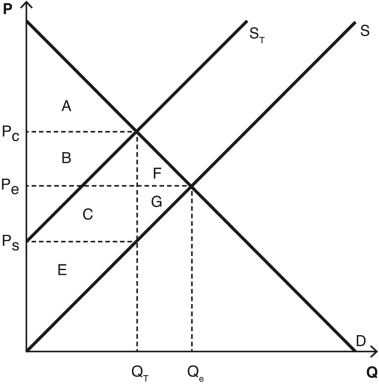

The following graph depicts a market where a tax has been imposed.Pe was the equilibrium price before the tax was imposed,and Qe was the equilibrium quantity.After the tax,PC is the price that consumers pay,and PS is the price that producers receive.QT units are sold after the tax is imposed.NOTE: The areas B and C are rectangles that are divided by the supply curve ST.Include both sections of those rectangles when choosing your answers.

-Which party is responsible for paying this tax out of pocket?

Definitions:

Blood Sugar

The concentration of glucose in the bloodstream, essential for providing energy to cells, and critical in managing conditions like diabetes.

Maslow's Hierarchy

A theory in psychology that arranges human needs in a pyramid, with basic needs at the bottom and self-actualization at the top.

Basic Need

Fundamental requirements necessary for sustaining human life, including food, water, shelter, and safety.

Subjective Well-Being

Self-perceived happiness or satisfaction with life. Used along with measures of objective well-being (for example, physical and economic indicators) to evaluate people’s quality of life.

Q5: Consider the market for socks.The current price

Q6: What would be the quantity demanded if

Q6: What good is most likely to have

Q38: A tax on milk would likely cause

Q57: If there are gains from specialization in

Q73: Which of the following characteristics best defines

Q94: What is the surplus when the price

Q103: Which of the following would be true

Q120: Super Economy Brand products have an income

Q131: A tax on milk would likely cause