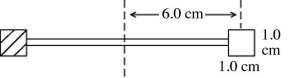

A radiometer has two square vanes (1.0 cm by 1.0 cm) ,attached to a light horizontal cross arm,and pivoted about a vertical axis through the center,as shown in the figure.The center of each vane is 6.0 cm from the axis.One vane is silvered and it reflects all radiant energy incident upon it.The other vane is blackened and it absorbs all incident radiant energy.An electromagnetic wave with an intensity of 0.30 kW/m2 is incident normally upon the vanes.What is the radiation pressure on the blackened vane? (c = 3.00 × 108 m/s, μ0 = 4π × 10-7 T ∙ m/A,ε0 = 8.85 × 10-12 C2/N ∙ m2)

Definitions:

Direct Tax

Direct Tax is a type of tax directly imposed on individuals or organizations, such as income tax or corporate tax, where the tax burden cannot be shifted to another party.

Marginal Tax Rate

The rate at which the last dollar of income is taxed, reflecting the percentage of additional income that must be paid in taxes.

Average Tax Rate

The ratio of the total amount of taxes paid by an individual or business to the total income or profit earned.

Fiscal Year

A twelve-month period used for accounting and financial reporting purposes, which may or may not align with the calendar year.

Q11: The figure shows four Gaussian surfaces surrounding

Q18: The atoms in a nickel crystal vibrate

Q20: Light strikes a 5.0-cm thick sheet of

Q22: 28)A sinusoidal electromagnetic wave is propagating in

Q27: An astronaut in an inertial reference frame

Q35: A metallic sheet has a large number

Q41: Light of wavelength 687 nm is incident

Q42: Three particles travel through a region of

Q66: A 2.0-m long conducting wire is formed

Q70: As shown in the figure,a wire is