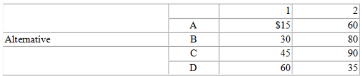

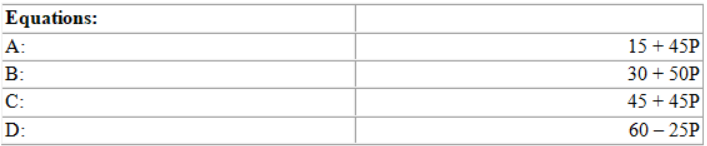

A manager has learned that annual profits from four alternatives being considered for solving a capacity problem are projected to be $15,000 for A, $30,000 for B, $45,000 for C, and $60,000 for D if state of nature 1 occurs; and $60,000 for A, $80,000 for B, $90,000 for C, and $35,000 for D if state of nature 2 occurs.

(i) If P(State of Nature 1) is .40, what alternative has the highest expected monetary value?

(ii) Determine the range of P(S2) for which each alternative would be optimal.

(i) Max EMV is C ($72)

(ii) Refer to the diagram, above.

Ranges:

D is optimal from 0 < .214

C is optimal from > .214 to 1.00

Definitions:

Smartphone

A device that has more capabilities than a cell phone, such as Internet connectivity, GPS tracking, running apps, taking pictures, playing music, or connecting wirelessly to other devices.

Driving

The operation of controlling a vehicle's movement and direction.

Tone Generator

A device that produces an audio signal of a specific frequency, often used in conjunction with a tracer to identify and diagnose the routing of cables and wires.

Patch Panel

A hardware assembly typically rack-mounted that consolidates cables from networking devices, allowing for easy management and routing.

Q13: A P/OM student has purchased a four-function

Q15: Developing work assignments in a job shop

Q21: If a company produces a variety of

Q39: Assembly of a radar unit has a

Q50: An operation analyst is forecasting this year's

Q69: A core process is a process that

Q104: Correlation measures the strength and direction of

Q119: Which one of the following is not

Q146: A company is designing a product layout

Q170: Disadvantages of naive forecasts include:<br>A)time-consuming to prepare<br>B)it