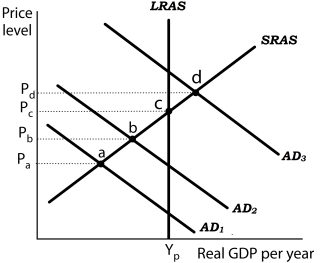

Figure 16-3

Panel (a) Panel (b)

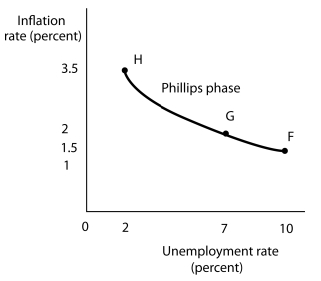

Suppose the level of potential output (YP) is $1,000 billion and the natural rate of unemployment is 5%. In Panel (a) , the aggregate demand curve in Period 1 is AD1. Assume that the price level in Period 1 has risen by 1.5% from the previous period and the unemployment rate is 10%. Thus, in Panel (b) point F shows an initial rate of inflation of 1.5% and an unemployment rate of 10%. Similarly, point b in Panel (a) corresponds to point G in Panel (b) and point d in Panel (a) corresponds to point H in Panel (b) .

Suppose the level of potential output (YP) is $1,000 billion and the natural rate of unemployment is 5%. In Panel (a) , the aggregate demand curve in Period 1 is AD1. Assume that the price level in Period 1 has risen by 1.5% from the previous period and the unemployment rate is 10%. Thus, in Panel (b) point F shows an initial rate of inflation of 1.5% and an unemployment rate of 10%. Similarly, point b in Panel (a) corresponds to point G in Panel (b) and point d in Panel (a) corresponds to point H in Panel (b) .

-Refer to Figure 16-3. The Phillips phase of the inflation-unemployment cycle is explained

Definitions:

Spot Rates

The current market price at which a particular asset can be bought or sold for immediate delivery.

Hedged Date

The date on which a hedge transaction is initiated to protect against future fluctuations in value.

Foreign Exchange Hedge

A financial transaction implemented to protect an investment or business operation from adverse movements in exchange rates.

Foreign Currency Futures

Financial contracts to exchange currencies on a specified future date at a predetermined price.

Q25: Alternative medicine includes natural or homeopathic remedies

Q40: Refer to Table 13-1. Negative personal saving

Q66: The Great Leap Forward was an economic

Q77: Use the theory behind the equation of

Q84: According to Karl Marx:<br>A) the surplus value

Q90: Marx predicted that:<br>A) profit rates would rise.<br>B)

Q107: According to Marx, the value of a

Q114: Karl Marx predicted the overthrow of the

Q124: If the U.S. exchange rate decreases relative

Q125: Suppose the U.S. is a major importer