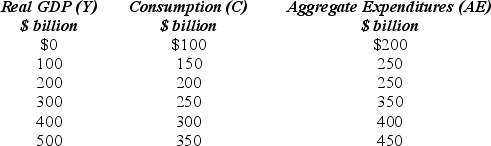

Table 13-2

-Refer to Table 13-2. Let Y = real GDP, AE = Aggregate Expenditures, C = Consumption,

IP = Planned Investment. Consider a simple economy that is made up of only two sectors, households and firms, and that all investment is autonomous. Further, disposable personal income = real GDP. Suppose autonomous investment rises by $50 billion. In the short run, this will cause

Definitions:

Income

Funds received routinely through work or investing activities.

Income Elasticity

An indicator of the degree to which demand for a product or service shifts following a variation in consumer income.

Housing

The provision of accommodation, typically through buildings or structures where individuals or families live.

Income Increase

A rise in the amount of money earned by an individual or collected by an organization, often measured on a monthly or yearly basis.

Q6: If the Fed's primary goal is price

Q12: A reallocation of resources to consumption goods

Q51: If the velocity of money is constant,

Q66: Suppose a country has a national debt

Q75: Refer to Figure 12-2. If discretionary fiscal

Q80: Refer to Figure 11-4. The shift in

Q109: Changes in the interest rate will lead

Q114: Consider a simple aggregate expenditure model where

Q134: Refer to Table 14-1. If the market

Q174: What are the three broad categories of