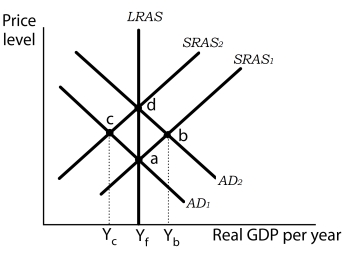

Figure 11-5

-Refer to Figure 11-5. If the economy is at point c,

Definitions:

LIFO

An inventory valuation method that assumes the items most recently put into inventory are the first ones sold.

Ending Inventory

The overall worth of items ready for sale after an accounting period, determined by starting inventory added to purchases and then subtracting the cost of goods sold.

Periodic Inventory System

An inventory accounting system where updates to the quantity and cost of inventory are made at specified intervals, such as monthly or yearly, not continuously.

FIFO Method

FIFO method, or First-In, First-Out, is an inventory costing method where the first items placed into inventory are the first ones sold, used for calculating cost of goods sold and ending inventory.

Q2: Suppose money supply (M) = $4,000, real

Q21: Refer to Table 9-2. In Year 1,

Q42: An expansionary fiscal policy is likely to

Q48: Holding everything else unchanged, higher interest rates

Q59: A liquidity trap is said to exist

Q73: Refer to Figure 12-2. At output level

Q86: Banks play two primary roles in the

Q87: Suppose the Fed conducts an open market

Q154: If the economy experiences an inflationary gap,

Q165: Which of the following is not a