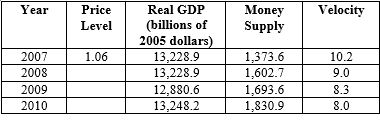

Exhibit 22-3

-According to the data in Exhibit 22-3, the rate of inflation between 2009 and 2010 was about

Definitions:

Traditional Overhead Costing Systems

Costing systems that allocate overhead to products based on predetermined overhead rates, often using direct labor hours or machine hours as the allocation base.

Allocated Overhead Costs

Expenses related to the indirect costs of production that are assigned to specific products or departments based on a formula or method.

Allocation Methods

Allocation methods are accounting strategies used to distribute costs or revenues among different departments, products, or processes within a company.

Overhead Costs

Indirect expenses related to the operation of a business that are not directly assignable to a specific product or service.

Q3: An increase in reserves leads to an

Q8: The growth rate of productivity due to

Q32: In the long run, a decrease in

Q38: Suppose businesses seriously believe that, within a

Q40: The official definition of a part-time worker

Q78: According to the labor-supply-and-demand model if the

Q96: The hyperinflation episodes in Brazil and Chile

Q128: If business confidence increases,<br>A) there will be

Q158: The term that best describes what happens

Q203: Assuming constant inflation, a shift of the