Figure 16-3

Panel (a) Panel (b)

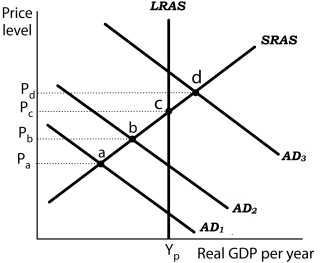

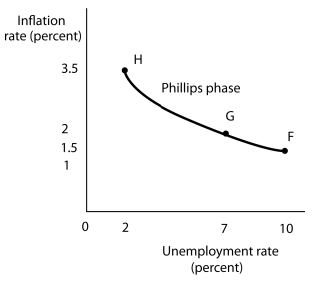

Suppose the level of potential output (YP) is $1,000 billion and the natural rate of unemployment is 5%. In Panel (a) , the aggregate demand curve in Period 1 is AD1. Assume that the price level in Period 1 has risen by 1.5% from the previous period and the unemployment rate is 10%. Thus, in Panel (b) point F shows an initial rate of inflation of 1.5% and an unemployment rate of 10%. Similarly, point b in Panel (a) corresponds to point G in Panel (b) and point d in Panel (a) corresponds to point H in Panel (b) .

Suppose the level of potential output (YP) is $1,000 billion and the natural rate of unemployment is 5%. In Panel (a) , the aggregate demand curve in Period 1 is AD1. Assume that the price level in Period 1 has risen by 1.5% from the previous period and the unemployment rate is 10%. Thus, in Panel (b) point F shows an initial rate of inflation of 1.5% and an unemployment rate of 10%. Similarly, point b in Panel (a) corresponds to point G in Panel (b) and point d in Panel (a) corresponds to point H in Panel (b) .

-Refer to Figure 16-3. Suppose the economy is operating at point a. What happens if

Policymakers undertake expansionary policies in period 1?

Definitions:

Preference Shares

Shares that give holders preferential treatment over common stock in dividend payments and upon liquidation, but usually do not have voting rights.

Cumulative Dividends

Dividend payments that must be paid out to preferred shareholders before any dividends can be issued to common shareholders.

Consolidated Balance Sheet

A balance sheet that provides a financial snapshot of a parent company and its subsidiaries as one single entity, consolidating all assets, liabilities, and equity.

Equipment

Tangible property used in the operation of a business that is not intended for sale in the ordinary course of business.

Q16: In the 1970s, the U.S. economy saw

Q20: New classical economists believe that the potential

Q28: Writing in 1752, David Hume's essay, "Of

Q113: An increase in the cost of capital

Q118: (Exhibit: Income Distribution) Curve B shows that

Q124: Refer to Figure 13-2. If real GDP

Q131: Because of careful planning, the former Soviet

Q143: Suppose Salvania's exports equal $500 billion and

Q173: Personal saving is<br>A) total income not spent

Q185: International trade affects the economy's real wage