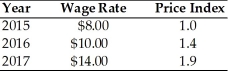

Refer to the information provided in Table 30.2 below to answer the question(s) that follow.

Table 30.2

-Refer to Table 30.2. From 2016 to 2017 the real wage

Definitions:

Payroll Tax

Levies placed on both employers and employees, computed based on a fraction of the wages that employers distribute to their workforce.

Income Levels

The categories of earnings that individuals or households fall into, typically used to analyze economic and demographic data.

Tax Incidence

The study of who ultimately pays the tax or bears the burden of tax, which can differ from the entity that initially pays the tax.

Total Burden

The complete impact, often in terms of costs or taxes, borne by society or specific groups within it.

Q22: Supply is determined by how much suppliers

Q50: A change in the price of a

Q62: Disembodied technical change is one reason why<br>A)

Q88: Refer to Figure 3.7. Assume the market

Q88: Refer to Figure 32.2. According to the

Q122: Refer to Table 3.1. If the price

Q196: _ believe that real output is determined

Q297: If the number of people employed is

Q298: If the substitution effect dominates the income

Q320: The average level of expected future income