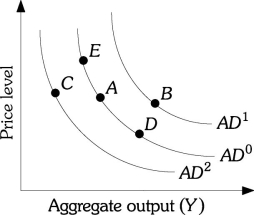

Refer to the information provided in Figure 27.1 below to answer the question(s) that follow.  Figure 27.1

Figure 27.1

-Refer to Figure 27.1. An aggregate demand shift from AD1 to AD2 can be caused by

Definitions:

Risk-free Asset

An investment with zero risk of financial loss, theoretically providing guaranteed returns, such as government bonds.

Portfolio Betas

Measures the volatility, or systemic risk, of a portfolio of investments relative to the overall market, indicating its sensitivity to market movements.

Greater Than 1.0

This term typically implies a value that exceeds one in magnitude, often used in financial ratios indicating a positive performance or ratio above one.

Slope of the SML

The gradient of the Security Market Line which reflects the trade-off between risk and return in financial markets.

Q18: If the combination r = 5% and

Q75: A higher interest rate increases both planned

Q115: If the aggregate supply is vertical, an

Q132: If the long-run aggregate supply curve is

Q138: According to classical economists, excessive unemployment does

Q167: In order for a barter transaction to

Q185: When money is used as a medium

Q187: Refer to Figure 28.8. Expected inflation equals

Q193: Refer to Figure 27.1. An aggregate demand

Q229: The enacted Gramm-Rudman-Hollings Act would tend to