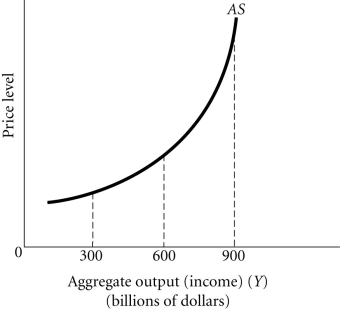

Refer to the information provided in Figure 26.2 below to answer the question(s) that follow.  Figure 26.2

Figure 26.2

-Refer to Figure 26.2. Between the output levels of $600 billion and $900 billion, the relationship between the price level and output is

Definitions:

Black-Scholes Option-pricing Model

A mathematical model for pricing European call and put options, using factors like the stock's price, exercise price, risk-free rate, and time to expiration.

Dividend Payouts

Distributions made to shareholders by a company, typically from earnings.

Time Value

The portion of an option's price that exceeds its intrinsic value, representing the potential for additional value based on time remaining until expiration.

Out-of-the-money

A term used in options trading to describe an option that would not profit if exercised immediately, i.e., a call option with a strike price above the underlying asset's price or a put option below it.

Q13: Other things equal, the unemployment rate falls

Q30: The type of unemployment that is most

Q80: If an increase in the Z factors

Q94: If the long-run aggregate supply curve is

Q129: After World War II, cigarettes were used

Q183: The views of the new classical economists

Q187: If the AD curve is relatively flat,

Q212: Frictional unemployment is the type that arises

Q215: Refer to Figure 28.3. A minimum wage

Q231: As commercial banks keep fewer excess reserves,