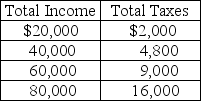

Refer to the information provided in Table 19.8 below to answer the question(s) that follow.

Table 19.8

-Related to the Economics in Practice on page 391: Refer to Table 19.8. At an income level of $60,000, the average tax rate is

Definitions:

Credit Account Balances

The amount owed by a borrower on a credit account, reflecting any purchases, payments, charges, or adjustments.

Equity

The value of an owner’s interest in a property or a business, after deducting liabilities and debts.

Dividends

Dividends are a portion of a company's earnings distributed to shareholders, usually in the form of cash payments or additional shares, reflecting the company's profitability and investment return.

Ledger Account

A record that keeps track of all the transactions related to a particular aspect of a business's finances, such as sales or assets.

Q17: Refer to Figure 2.3. Assume that in

Q40: A Gini coefficient of 0.25 represents less

Q70: A decrease in the overall price level

Q70: If an aid program is mandated at

Q73: From 1935 to 2009, the yield per

Q98: In general, risk-loving individuals experience increasing marginal

Q142: Which of the following taxes would impose

Q170: The economic problem can best be stated

Q179: Production inefficiency occurs<br>A) only when an economy

Q191: The employment rate is the number of