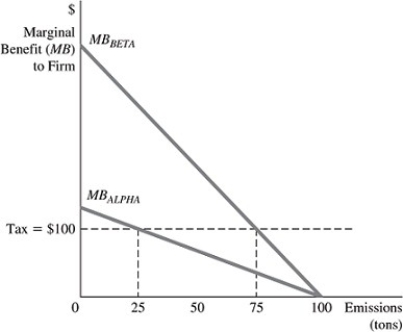

Refer to the information in Figure 16.5 below to answer the question(s) that follow.  Figure 16.5

Figure 16.5

Figure 16.5 shows the marginal benefits of emitting pollution for the only two chemical companies in an industry, Alpha Chemicals and Beta Chemicals. Before any tax on pollution emissions is imposed, each company views pollution as being free.

-Refer to Figure 16.5. The government decides to impose a tax on pollution emissions to cut total emissions in this industry in half, and based on this decision it has set the tax at $100 per ton of emissions. Following the implementation of this tax, the total amount of tax revenue collected by the government from this tax will be

Definitions:

Portfolio Development

The process of creating a comprehensive collection of an individual's work products, projects, or achievements to showcase their skills.

Essential Elements

Fundamental components or factors necessary for a system or structure to function effectively.

Prospective Employer

A company or person that one is considering or being considered by for employment.

Second Interview

A follow-up meeting in the job interview process, offering the employer and the candidate another opportunity to assess mutual suitability.

Q2: Refer to Table 17.2. Sue earns $40,000

Q15: Air pollution generated by a steel mill

Q18: One reason for selecting a section of

Q23: The notion of utilitarian justice is that<br>A)

Q36: Average total cost is minimized in long-run

Q50: When firms enter a monopolistically competitive industry,

Q119: The feature that distinguishes perfect competition from

Q167: A medical student's internship at a local

Q169: Refer to Table 14.4. The Nash equilibrium

Q216: A common resource is<br>A) excludable and rival