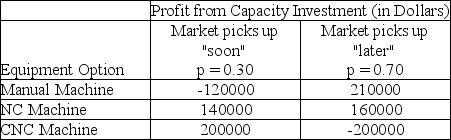

Steve Gentry, the operations manager of Baja Fabricators, wants to purchase a new profiling machine (it cuts compound angles on the ends of large structural pipes used in the fabrication yard). However, because the price of crude oil is depressed, the market for such equipment is down. Steve believes that the market will improve in the near future and that the company should expand its capacity. The table below displays the three equipment options he is currently considering, and the profit he expects each one to yield over a two-year period. The consensus forecast at Baja is that there is about a 30% probability that the market will pick up "soon" (within 3 to 6 months) and a 70% probability that the improvement will come "later" (in 9 to 12 months, perhaps longer).

a. Calculate the expected monetary value of each decision alternative.

a. Calculate the expected monetary value of each decision alternative.

b. Which equipment option should Steve take?

Definitions:

Quarterly Deposits

Regular deposits made into an investment or savings account every three months.

Future Value

Future value is a financial concept that estimates how much an investment will be worth at a future date, considering factors like interest earned or capital gains.

Compounded Quarterly

Refers to the process where interest is calculated and added to the principal sum every quarter (every three months) so that subsequent interest calculations are based on the increased principal.

Annual Lease Payments

The total amount paid over a year for the use of leased property or equipment.

Q12: A work system has five stations that

Q17: What is the expected value with perfect

Q28: Explain how a load-distance model helps solve

Q29: Which of the following is false regarding

Q30: The transportation method is a special case

Q46: A manufacturer of semiconductor "wafers" has been

Q82: The _ develops an initial feasible solution

Q83: Which of the following techniques is not

Q88: How does the Starbucks Coffee case illustrate

Q117: A manufacturing plant is trying to determine