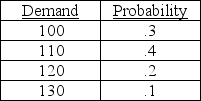

A product has a reorder point of 110 units, and is ordered four times a year. The following table shows the historical distribution of demand values observed during the reorder period.

Managers have noted that stockouts occur 30 percent of the time with this policy, and question whether a change in inventory policy, to include some safety stock, might be an improvement. The managers realize that any safety stock would increase the service level, but are worried about the increased costs of carrying the safety stock. Currently, stockouts are valued at $20 per unit per occurrence, while inventory carrying costs are $10 per unit per year. What is your advice? Do higher levels of safety stock add to total costs, or not? What level of safety stock is best?

Managers have noted that stockouts occur 30 percent of the time with this policy, and question whether a change in inventory policy, to include some safety stock, might be an improvement. The managers realize that any safety stock would increase the service level, but are worried about the increased costs of carrying the safety stock. Currently, stockouts are valued at $20 per unit per occurrence, while inventory carrying costs are $10 per unit per year. What is your advice? Do higher levels of safety stock add to total costs, or not? What level of safety stock is best?

Definitions:

Interest

The cost paid for borrowing money, typically expressed as a percentage of the total amount loaned.

Periodic Inventory

An inventory accounting system where inventory and cost of goods sold are determined at the end of an accounting period based on a physical count.

Defaulted Note

A note or loan for which the borrower has failed to make the agreed-upon payments by the due date.

Account

An accounting device used in bookkeeping to record increases and decreases of business transactions relating to individual assets, liabilities, capital, withdrawals, revenue, expenses, and so on.

Q27: Most people would argue that a service

Q29: ABC analysis divides on-hand inventory into three

Q34: Identify the reasons for making in the

Q45: Compare the assumptions of the production order

Q52: Because Hard Rock Cafes are themed restaurants,

Q65: When a worker obtains clear and timely

Q99: Service level is the complement of the

Q109: Describe finite capacity scheduling in a sentence

Q123: The operations manager performs the management activities

Q144: Provide examples of non-monetary incentives.