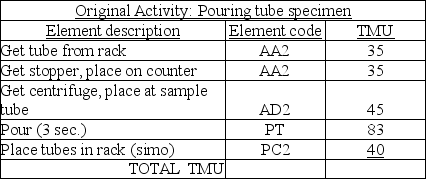

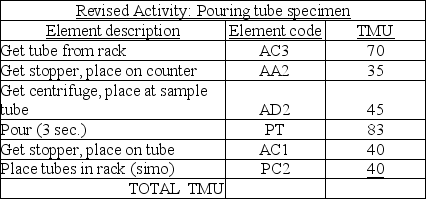

An initial analysis of a laboratory activity resulted in the first table below. After this analysis, the managers determined that their element descriptions were not as accurate as they should have been-they had left out an element, underestimated a distance, and understated the need for accuracy. They revised the table of element data, which appears in the second table.

Calculate the total standard minutes for the original activity "pouring tube specimen." Calculate the total standard minutes for the revised activity "pouring tube specimen." What is the increase, in seconds, from the first version to the second?

Calculate the total standard minutes for the original activity "pouring tube specimen." Calculate the total standard minutes for the revised activity "pouring tube specimen." What is the increase, in seconds, from the first version to the second?

Definitions:

Target Cost

A pricing strategy that involves determining the desired cost for a product in order to meet a specified profit margin by working backwards from a competitive market price.

Job Costing

A cost accounting method used to track the costs associated with producing individual jobs, allowing businesses to estimate profitability on a per-job basis.

Direct Costs

Expenses that can be directly attributed to the production of specific goods or services, such as raw materials and labor.

Job Cost Sheet

A record or document used in job order costing that summaries the costs associated with a particular job, including materials, labor, and overhead.

Q1: In the past half-century, while the number

Q17: The actual average observed time for a

Q27: Little Jennie is energetic, friendly, self-reliant, independent,

Q29: The multiyear process triggered by a falloff

Q53: Equitable pay alone cannot achieve a reasonable

Q120: The marketing function's main concern is with<br>A)

Q145: Since the 1960s, American working dads have

Q153: Fredrick W. Taylor is credited with introducing

Q167: A manager who is conducting a time

Q273: The period of life when people are