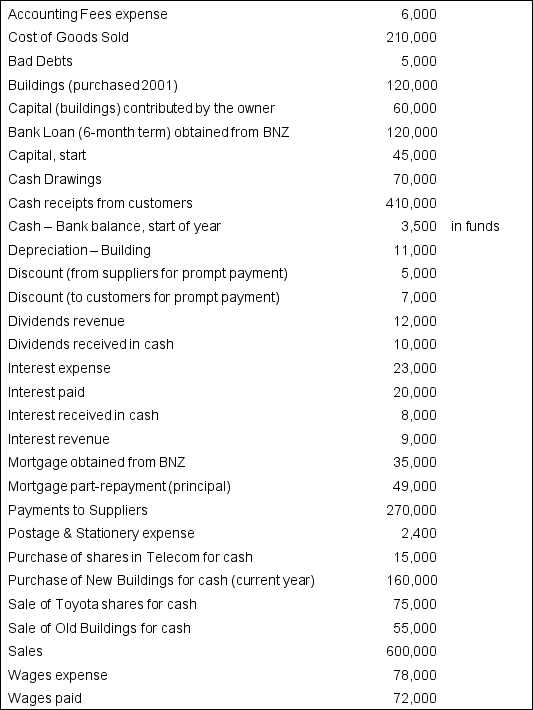

The following is a list of amounts taken from the records of Don's Dents,a second-hand car sales yard operating in Taranaki,for the year to 31/12/20X1.

a Prepare a fully classified Cash Flow Statement for the year ending 31 December 20X1.(Note: some items listed are not cash flow items. )

a Prepare a fully classified Cash Flow Statement for the year ending 31 December 20X1.(Note: some items listed are not cash flow items. )

b Comment on Don's cash flows,in regard to operating,investing and financing activities,the ending cash bank balance,and any items you consider are relevant.

c Assume Don's net profit on his Income Statement is $210,000.Compare this with the final net operating cash flow for the business,and suggest reasons for the difference.

d Make 3 recommendations to Don in regard to his cash flows and cash position.

Definitions:

Capital

Financial assets or resources that businesses or individuals use to fund operations, investments, and growth.

Ordinary Business Income

Income earned from the normal business operations, subject to regular tax rates.

Subchapter S

A section of the Internal Revenue Code that allows corporations to pass income directly to shareholders and avoid double taxation while retaining the benefits of corporate structure.

Schedule K-1

A tax form used to report a beneficiary's share of income, deductions, and credits from a partnership, S corporation, or trust.

Q6: What does it mean for a model

Q7: If L is the number of exogenous

Q7: The following are the transactions for Tara's

Q8: a What advantages are there in showing

Q15: Why is the variance of the

Q23: How do human activities such as deforestation

Q50: One prediction about global warming is that

Q58: What does a psychologist usually mean when

Q94: A bird species responds to earlier spring

Q101: Which sequence represents the correct size