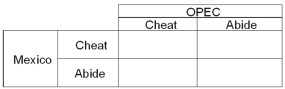

Mexico and OPEC both produce crude oil.Realizing that it would be in their best interest to form an agreement on production goals,a meeting is arranged and an informal,verbal agreement is reached.If both Mexico and OPEC stick to the agreement,OPEC will earn profit of $200 million and Mexico will earn profit of $100 million.If both Mexico and OPEC cheat,then OPEC will earn $175 million and Mexico will earn $80 million.If only OPEC cheats,then OPEC earns $185 million and Mexico $60 million.If only Mexico cheats,then Mexico earns $110 million and OPEC $150 million.

-Refer to the information given above.The outcome of this game is

Definitions:

Accelerated Depreciation

A method of depreciation that allows a larger portion of an asset's cost to be deducted in the early years of useful life.

Freight Costs

The expenses incurred to transport goods from one location to another.

Useful Life

The estimated duration of time that an asset is expected to be functional and economically viable for its intended purpose.

Salvage Value

The calculated future selling price of an asset at the end of its period of benefit.

Q30: Which of the following are conditions for

Q39: If a product's performance falls short of

Q63: International advertisers must determine the degree to

Q81: A corporate VMN has the advantage of

Q86: A product in the maturity stage will

Q126: Refer to the payoff matrix above.This game

Q150: _ rewards are cash,merchandise or service rewards

Q157: The incentive to cheat is strong in

Q162: Coupons,contests,cents-off deals and premiums are all examples

Q172: Suppose that a regulated natural monopolist has