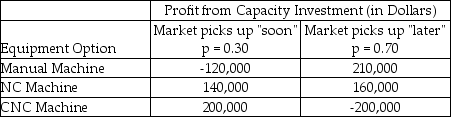

Steve Gentry,the operations manager of Baja Fabricators,wants to purchase a new profiling machine (it cuts compound angles on the ends of large structural pipes used in the fabrication yard).However,because the price of crude oil is depressed,the market for such equipment is down.Steve believes that the market will improve in the near future and that the company should expand its capacity.The table below displays the three equipment options he is currently considering,and the profit he expects each one to yield over a two-year period.The consensus forecast at Baja is that there is about a 30% probability that the market will pick up "soon" (within 3 to 6 months)and a 70% probability that the improvement will come "later" (in 9 to 12 months,perhaps longer).

a.Calculate the expected monetary value of each decision alternative.

a.Calculate the expected monetary value of each decision alternative.

b.Which equipment option should Steve take?

Definitions:

Q3: A learning curve:<br>A)plots man-hours per dollar versus

Q8: For the problem data set below,what is

Q18: _ is the criterion for decision making

Q21: _ is the use of information technology

Q24: Constraints are needed to solve linear programming

Q24: What decision criterion would be used by

Q29: Identify,in order,the five steps required to implement

Q41: A do-it-yourself homeowner is installing a new

Q73: What are the advantages and disadvantages of

Q74: The fixed-position layout would be MOST appropriate