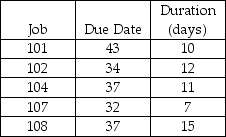

The following jobs are waiting to be processed at your work center,which cleans valve body castings.Job numbers are assigned sequentially upon arrival in the facility (a missing number means that job does not require your work center).All dates are specified as days from today.

a.In what sequence should the jobs be processed according to the FCFS scheduling rule?

a.In what sequence should the jobs be processed according to the FCFS scheduling rule?

b.In what sequence should the jobs be processed according to the EDD scheduling rule?

c.In what sequence should the jobs be processed according to the SPT scheduling rule?

d.In what sequence should the jobs be processed according to the LPT scheduling rule?

e.In what sequence should the jobs be processed according to the critical ratio scheduling rule?

Definitions:

Permanent Differences

These are variations between taxable income and accounting income that originate from certain items being recognized in one manner for tax purposes and another for financial reporting purposes and do not reverse over time.

Pretax Financial Accounting

The process of preparing financial statements that calculate revenues, expenses, and earnings before taxes are deducted.

Taxable Income

The portion of income that is subject to income tax after adjustments, deductions, and exemptions are applied.

Comprehensive Allocation

The process of distributing costs across multiple departments, projects, or activities in a thorough and extensive manner.

Q6: Thomas' Bike Shop stocks a high volume

Q18: A project manager is interested in crashing

Q22: Infant mortality refers to the high failure

Q25: Suppose that a three-stage process had reliability

Q43: The inverse of the mean time between

Q53: ABC analysis is based on the presumption

Q85: What theory implies that you should allow

Q99: Which of the following has progressed the

Q105: Closed-loop MRP systems allow production planners to

Q107: Five welding jobs are waiting to be