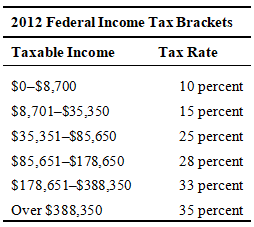

Refer to the following table to answer the following questions:

-Using the table,what is the new average tax rate for a person who currently makes $80,000 per year and receives a $10,000 raise?

Definitions:

Tax Expense

The amount of taxation a company is required to pay to various tax authorities, based on its earnings.

SUTA Tax Payable

The liability owed by employers to the state for the State Unemployment Tax Act, used to fund unemployment benefits.

Payroll Tax Expense

Payroll Tax Expense is the employer's cost associated with the employment of staff, including taxes such as social security and Medicare taxes that must be paid based on salaries.

Wages Payable

A liability account representing the amount owed to employees for work performed but not yet paid.

Q2: When the government decreases spending or increases

Q19: What limits the moral hazard problem in

Q34: In equation form,the production function for a

Q42: The economy is in short-run equilibrium when<br>A)

Q74: Suppose that the Bank of Oranges has

Q75: As a proposed solution to entitlement reform,_

Q82: An increase in the minimum wage leads

Q114: Which of the following statements is true

Q133: The value of one's accumulated assets is

Q170: Between 2000 and 2010,real government outlays in