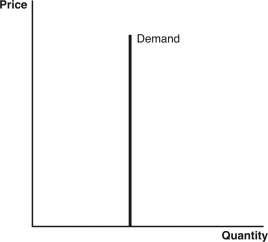

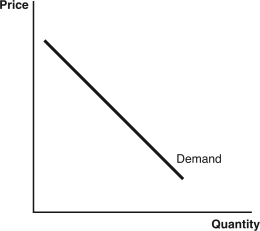

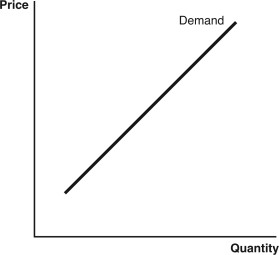

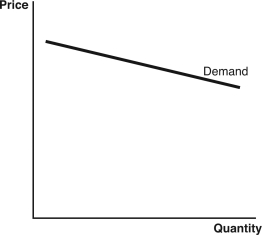

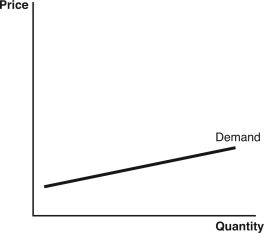

Use the following graphs to answer the following questions:

A.

B.

B.

C.

C.

D.

D.

E.

E.

-Which graph best describes the demand for an elective surgery that is so price sensitive that doctors have to issue coupons to get more patients?

Definitions:

Straight-Line Method

A technique in accounting for evenly spreading the cost of an asset over its useful life.

Net Advantage to Leasing

The potential financial benefits gained from leasing an asset, compared to purchasing it outright, considering taxes, maintenance, and other factors.

Pre-Tax Cost

The cost or expense incurred by a business before the deduction of taxes.

CCA Class

It stands for Capital Cost Allowance Class, a categorization in tax systems for different types of depreciable properties to determine the depreciation rate for tax purposes.

Q1: Whenever consumers make decisions without perfect information,the

Q28: Why is the demand for health care

Q33: In 2000,researchers Brigitte Madrian and Dennis Shea

Q50: What are the two exceptions to convex

Q60: Noelle's mother has always said,"If you want

Q63: A key component in the Affordable Care

Q78: A student who is risk neutral would

Q90: Which statement best represents the phenomenon of

Q94: When there is a change in purchasing

Q124: What is the expected value of Gamble