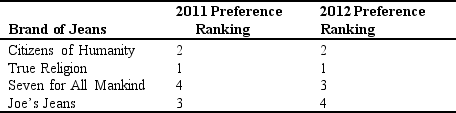

The following table shows Alexi's preference ranking for different brands of jeans for 2011 and 2012.His preferences are ranked from 1 to 4,where 4 is his most-preferred brand and 1 is his least-preferred brand.In 2011,1,439 of the 28,000 men attending Alexi's college owned a pair of Joe's Jeans.In 2012,a survey showed that 9,421 of the 28,560 men attending Alexi's college owned a pair of Joe's Jeans.Based on this information,the change in Alexi's preference ranking for Joe's Jeans from 2011 to 2012 can be best explained by the ________ effect.

Definitions:

Straight-Line Depreciation

A method of allocating the cost of a tangible asset over its useful life in equal annual installments.

Tax Loss Carryovers

Provisions that allow businesses or individuals to use their current losses to offset future profits or income for tax purposes, potentially reducing future tax liabilities.

Tax Rate

The percentage of an individual's or corporation's income taken as tax.

Leasing NET Advantage

An analysis to determine the economic benefit or cost of leasing an asset compared to purchasing it outright, considering tax implications and other factors.

Q46: The Nash equilibrium in an oligopolistic market

Q55: Which of the following is an example

Q75: What is the degree of income inequality

Q77: Outsourcing has been a controversial topic ever

Q94: We cannot purchase a cable subscription for

Q99: Marie's Car Dealership is the only dealership

Q113: Which of the following is characteristic of

Q116: Using different words as search criteria can

Q150: Explain the activities that the Clayton Act

Q173: If there are exactly 20 firms in