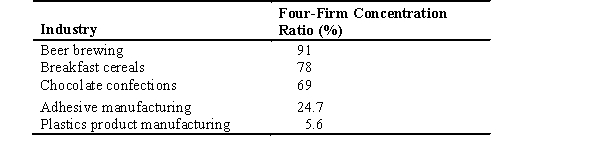

The following table shows the four-firm concentration ratios for five separate industries.Use this table to answer the following questions:

-In which industry do the four largest firms collectively have the least market power?

Definitions:

Federal Personal Income Tax

A tax levied by the federal government on the income of individuals, with rates varying based on income levels.

Tax Exemptions

Deductions allowed by law to reduce taxable income, often for specific categories of expenses or investments.

Progressive

Pertaining to a type of tax system where the tax rate increases as the taxable amount or income increases, often aimed at reducing income inequality.

Incidence of Taxation

Refers to who ultimately bears the financial burden of a tax, which can differ from who initially pays the tax.

Q1: If you know that the substitution effect

Q12: Why is the minimum wage an ineffective

Q32: No matter how high his wage rises,Johann

Q37: The consumer optimum<br>A) occurs when utility declines

Q64: Marginal utility is negative<br>A) at all levels

Q70: A formerly quiet town with fantastic weather

Q80: One of the benefits of perfect price

Q83: Perfect substitutes produce an indifference curve with

Q137: How does diminishing marginal product affect the

Q171: The maximum long-run economic profit earned by