Use the following information to answer the following questions.

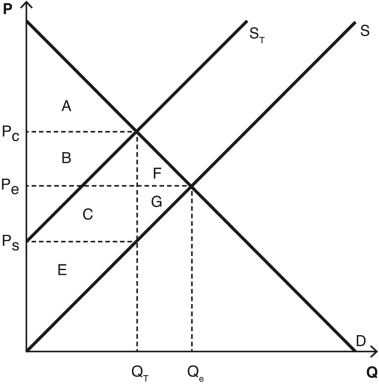

The following graph depicts a market where a tax has been imposed.Pe was the equilibrium price before the tax was imposed,and Qe was the equilibrium quantity.After the tax,PC is the price that consumers pay,and PS is the price that producers receive.QT units are sold after the tax is imposed.NOTE: The areas B and C are rectangles that are divided by the supply curve ST.Include both sections of those rectangles when choosing your answers.

-Which areas represent consumer surplus after the tax is imposed?

Definitions:

Conditional Warranties

Warranties that are only effective under certain conditions or circumstances, often requiring specific actions or maintenance by the buyer.

Unconditional Warranties

Guarantees provided by manufacturers or sellers that do not impose conditions on the validity of the warranty.

Implied Warranties

Legal guarantees that automatically apply to products or services, ensuring they meet certain minimum standards.

Uniform Commercial Code Sections 2-508 and 2A-513

Specific provisions within the UCC related to the rights of parties in sales of goods and leases, respectively.

Q23: Explain the relationship between the marginal cost

Q27: As a seller of a product subject

Q42: During a national recession,we see the income

Q46: Suppose Lewis lives in a community with

Q46: Supply and demand both tend to become

Q60: When two goods are unrelated then<br>A) cross-price

Q65: One strategy someone might use to be

Q106: A real-life,long-run example of a binding price

Q127: What is the surplus when the price

Q162: A tax on consumers would cause the