Use the following information to answer the following questions.

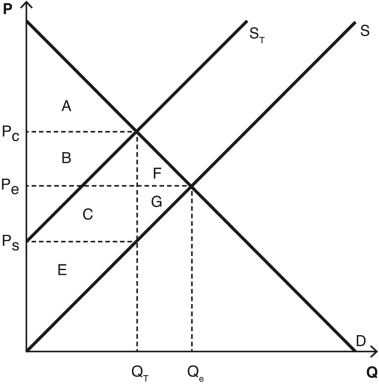

The following graph depicts a market where a tax has been imposed.Pe was the equilibrium price before the tax was imposed,and Qe was the equilibrium quantity.After the tax,PC is the price that consumers pay,and PS is the price that producers receive.QT units are sold after the tax is imposed.NOTE: The areas B and C are rectangles that are divided by the supply curve ST.Include both sections of those rectangles when choosing your answers.

-Which areas represent producer surplus after the tax is imposed?

Definitions:

Salvage Value

The projected residual worth of an asset after it has served its intended period.

Plant Assets

Long-term tangible assets used in the operation of a business that are not intended for resale, such as machinery, buildings, and land.

Year Ended

Refers to the end of a fiscal year, when a company completes its annual accounting period.

Depreciation Expense

The systematic allocation of the cost of a tangible asset over its useful life, reflecting the asset's consumption or wear and tear.

Q36: When the government places a tax on

Q39: If the cross-price elasticity of demand is

Q45: Something is a normal good if the

Q64: A supply schedule<br>A) is a curve representing

Q105: The difference between the willingness to pay

Q109: A major reason why public goods are

Q110: Explain the difference between efficiency and equity.Which

Q142: Which of the following statements are true

Q157: When pollution (a negative externality)is created by

Q161: Christopher's roommate is studying to be a