Use the following information to answer the following questions.

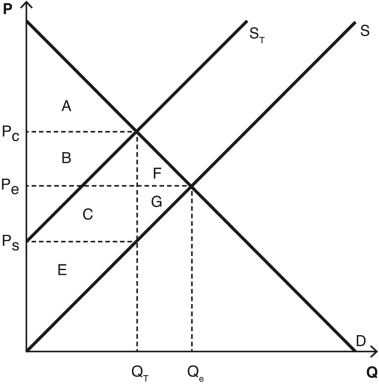

The following graph depicts a market where a tax has been imposed.Pe was the equilibrium price before the tax was imposed,and Qe was the equilibrium quantity.After the tax,PC is the price that consumers pay,and PS is the price that producers receive.QT units are sold after the tax is imposed.NOTE: The areas B and C are rectangles that are divided by the supply curve ST.Include both sections of those rectangles when choosing your answers.

-What is the amount of the tax,as measured along the y axis?

Definitions:

Marginal Product

Marginal Product is the additional output resulting from a one-unit increase in the quantity of a particular input, holding all other inputs constant.

Labor

Refers to the human effort, both physical and mental, used in the production of goods and services.

Output

The amount of goods or services produced by a company, industry, or economy within a certain period.

Revenue

The total income generated by a company or organization from its normal business operations.

Q24: Let's say that Esther is a politician

Q30: All taxes create some deadweight loss except

Q70: Consumer surplus is the difference between<br>A) supply

Q73: Suppose Solomon lives in a community with

Q73: Which of the quantity (Q)and price (P)combinations

Q74: Consider a market where production of the

Q115: A good that is nonrival and nonexcludable

Q154: The economic entity most likely to engage

Q166: Consider the production of a private good,such

Q170: At very low tax rates_ is much