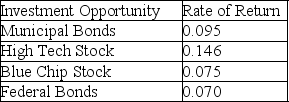

First Securities, Inc., an investment firm, has $380,000 on account.The chief investment officer would like to reinvest the $380,000 in a portfolio that would maximize return on investment while at the same time maintaining a relatively conservative mix of stocks and bonds.The following table shows the investment opportunities and rates of return.

The Board of Directors has mandated that at least 60 percent of the investment consist of a combination of municipal and federal bonds, 25 percent Blue Chip Stock, and no more than 15 percent High Tech Stock.Formulate this portfolio selection problem using linear programming.

The Board of Directors has mandated that at least 60 percent of the investment consist of a combination of municipal and federal bonds, 25 percent Blue Chip Stock, and no more than 15 percent High Tech Stock.Formulate this portfolio selection problem using linear programming.

Definitions:

Gate Control Theory

A theory of pain holding that structures in the spinal cord act as a gate for sensory input that is interpreted as pain.

Emotions

Complex psychological states that involve physiological arousal, expressive behaviors, and conscious experience.

Anzio Beachhead

A military operation during World War II where Allied forces landed on the beaches of Anzio, Italy, attempting to bypass German defenses and capture Rome.

Chronic, Intractable

Describes a condition or disease that is long-lasting and difficult, if not impossible, to cure or alleviate.

Q6: The cornerstone of game theory is Harsanui

Q8: The Greatest Generation Food Company wishes to

Q10: David and Beth Sheba run a health

Q11: Given the following two-person game, which strategy

Q25: Given the following opportunity loss function, determine

Q32: The minimal-spanning tree technique would best be

Q39: The saddle point is always the largest

Q47: The unit normal loss integral can be

Q79: The term slack is associated with ≥

Q89: Consider a product mix problem, where the