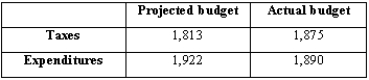

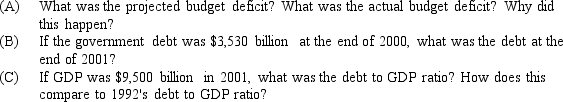

Suppose you have the following data on projected and actual figures for the U.S. budget for 2001 (in billions of dollars):

Definitions:

Eligible Dividends

Dividends designated by a company to be eligible for a lower tax rate in the hands of shareholders, often under specific tax jurisdictions.

Average Tax Rate

The proportion of total income that is paid as tax, calculated by dividing the total tax paid by the taxpayer's total income.

Average Tax Rate

The proportion of total income paid as taxes, calculated by dividing the total amount of taxes paid by the taxpayer's total income.

Interest Income

Revenue earned from deposit accounts or investments that pay interest, such as savings accounts, bonds, or interest-bearing loans.

Q11: When the rate of inflation is low

Q43: All else equal, regions with high capital

Q52: The positive correlation between real interest rates

Q61: When using discretionary fiscal policy to counter

Q68: The inflation adjustment line (IA) shows the

Q109: Suppose that, at any given level of

Q118: The table below shows the level of

Q128: The economic fluctuations model is used by

Q135: If the Fed raises interest rates because

Q162: Suppose, for some hypothetical economy, an electric