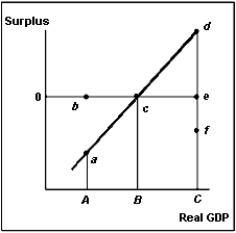

If real GDP equals B in the figure below, then

Definitions:

FIFO and LIFO

Inventory valuation methods; FIFO (First In, First Out) assumes that the earliest goods purchased are the first to be sold, while LIFO (Last In, First Out) assumes the reverse.

LIFO Inventory

A method of inventory valuation where the last items added to inventory are the first ones assumed to be sold, typically used to decrease tax liabilities under inflationary conditions.

Ending Inventory

The value of goods available for sale at the end of an accounting period, calculated by adding new purchases to beginning inventory and then subtracting goods sold.

Periodic Inventory System

An inventory system in which the inventory records are updated only after a physical count has been taken at periodic intervals, usually at the end of an accounting period.

Q13: A central bank increases its inflation target

Q18: If government spending decreases, the long-run income

Q49: Between 2001 and 2007<br>A)the United States economy

Q56: Which of the following is not an

Q67: More than 50 percent of the world's

Q67: In which of the following years was

Q98: Is the interest rate on the federal

Q107: A supplemental is<br>A)another term for transfer payments.<br>B)changes

Q129: If the target inflation rate is 3

Q163: Why do wages and prices exhibit inertia?<br>