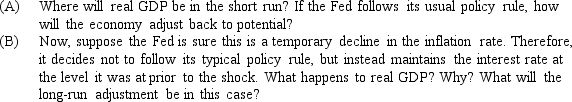

Suppose the target rate of inflation is 3 percent and real GDP equals potential GDP. Now, suppose a major oil-producing country decides to increase the supply of oil in order to discipline the other members of the oil-producing cartel. There is a sharp decline in the price of oil, and, in turn, the rate of inflation falls to 2 percent in the short run. The Fed views this decline in inflation as temporary and expects the price adjustment line to shift back up to 3 percent next year, which it does.

Definitions:

Bootstrapping

Funding a business startup or growth through internal cash flow and without external investment.

Expand

To increase in size, volume, number, or scope.

Outside Investors

Individuals or entities that invest capital in a business but are not part of its daily operations or management.

Penny Pinching

A term used to describe the act of being very careful with money and spending it sparingly.

Q2: Data for the U.S. economy in the

Q20: When the Fed changes monetary policy to

Q26: If the rest of the world falls

Q39: Assuming everything else held constant, suppose there

Q46: The size of the MPC determines how

Q62: In 2009, QE1 involved<br>A)cutting some interest rates

Q80: The economic fluctuations model is used<br>A)for all

Q105: Which of the following types of taxes

Q128: The flat inflation adjustment line describes the

Q130: The relationship between real interest rates and