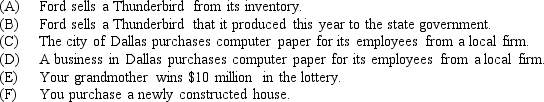

Determine in which spending category, if any, each of the following transactions would be recorded.

Definitions:

Temporary Difference

A difference between the carrying amount of an asset or liability in the balance sheet and its tax base that will result in taxable or deductible amounts in future years.

Effective Tax Rate

The average rate at which an individual or corporation is taxed, calculated by dividing the total tax paid by the taxable income.

Statutory Tax Rate

The official tax rate set by law that companies and individuals must pay on their income.

Deferred Tax Liabilities

Tax liabilities that emerge from the temporary discrepancies between the accounting and tax valuation of assets and liabilities.

Q16: The CPI is a measure of<br>A)the price

Q22: Which of the following is not a

Q48: Suppose the government is deciding between either

Q89: A positive externality occurs when the marginal

Q94: Why do economists believe that the CPI

Q98: Depreciation occurs when<br>A)machines wear out.<br>B)factories get old.<br>C)capital

Q103: The recession phase<br>A)is no longer a phase

Q140: If inventories increase in a given year,

Q141: Capital, as defined in the text, is

Q163: The government can internalize externalities by producing