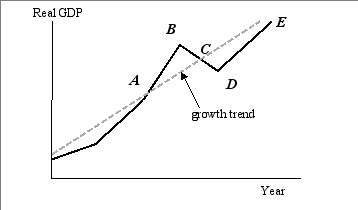

Exhibit 17-1

-In Exhibit 17-1, the best example of an expansion phase is

Definitions:

Expected Rate

An anticipated return or interest rate forecasted for an investment over a specific period.

Capital Asset Pricing Model

A model that describes the relationship between systematic risk and expected return for assets, particularly stocks, suggesting that the expected return on an investment is related to its risk level.

Portfolio Variance

A measure of the dispersion of returns of a portfolio from its mean, indicating the level of investment risk.

Portfolio Beta

A measure of the sensitivity of a portfolio's returns to market returns, representing its relative market risk.

Q20: Many people argue that the surest way

Q51: When the government uses a subsidy in

Q57: A decrease in real interest rates will

Q79: Depreciation of physical capital occurs because it<br>A)is

Q84: According to the data in Exhibit 18-3,

Q110: Pollution-abatement expenditures are<br>A)taxes on companies that produce

Q137: GDP is<br>A)a term used for economic growth.<br>B)a

Q146: In Exhibit 17-1, the best example of

Q164: Suppose businesses seriously believe that, within a

Q179: Differences in unemployment rates among young people