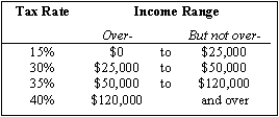

Exhibit 14-3

-Refer to Exhibit 14-3. Calculate the tax to be paid on $45,000 in gross income when the standard deduction and exemptions total $7,500.

Definitions:

Standard Deviation

A statistical measure that represents the dispersion or variation of a set of data values, indicating how much the individual data points differ from the mean.

P-chart

A control chart variant employed in statistical quality management for tracking the percentage of defective products in a procedure as time progresses.

Variable Sample Size

A sampling method where the size of the sample can change based on the experiment or study being conducted.

Standard Deviation

A measure of the amount of variation or dispersion of a set of values.

Q7: A command and control restriction could<br>A)raise prices

Q18: Soft drink distributors commonly use the practice

Q18: In reality, it is more difficult to

Q41: The regulatory capture theory suggests that the

Q65: Which of the following types of tax

Q111: In order to calculate marginal revenue product

Q125: Which of the following asset markets offers

Q146: Weekly earnings for the average worker have

Q164: Prior to the selling of the radio

Q167: What is the difference between a proportional