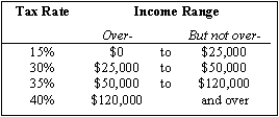

Exhibit 14-3

-Refer to Exhibit 14-3. Calculate the average tax rate of an individual whose taxable income is $65,000 and who has total deductions and exemptions of $10,000.

Definitions:

AVC

Average Variable Cost is the total variable costs divided by the quantity of output produced.

AFC

Average Fixed Cost, the fixed cost per unit of output, calculated by dividing total fixed costs by the quantity produced.

Average Total Cost

The total cost of production (fixed and variable costs combined) divided by the total quantity of output produced.

Average Fixed Cost

The fixed cost per unit produced, calculated by dividing total fixed costs by the quantity of output produced.

Q11: Consider the following income tax schedule for

Q27: Give two explanations why college graduates earn

Q38: Which of the following statements about discrimination

Q46: The demand curve for the labor market

Q72: The Herfindahl-Hirschman index rises as concentration in

Q92: Exhibit 15-3 shows the preference rankings of

Q107: All other things being equal, which of

Q127: Whether cable television is a natural monopoly

Q127: Label each of the following as financial

Q146: Tax incidence refers to who bears the