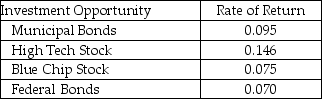

First Securities, Inc., an investment firm, has $380,000 on account. The chief investment officer would like to reinvest the $380,000 in a portfolio that would maximize return on investment while at the same time maintaining a relatively conservative mix of stocks and bonds. The following table shows the investment opportunities and rates of return.  The Board of Directors has mandated that at least 60 percent of the investment consist of a combination of municipal and federal bonds, 25 percent Blue Chip Stock, and no more than 15 percent High Tech Stock. Formulate this portfolio selection problem using linear programming.

The Board of Directors has mandated that at least 60 percent of the investment consist of a combination of municipal and federal bonds, 25 percent Blue Chip Stock, and no more than 15 percent High Tech Stock. Formulate this portfolio selection problem using linear programming.

Definitions:

Chinese Americans

Individuals of Chinese descent who are citizens or residents of the United States, encompassing a diverse group with varying cultural, linguistic, and historical backgrounds.

Chinese Identity

The sense of belonging to the Chinese culture, encompassing its traditions, language, and history.

Social Loafing

A tendency to exert less effort when performing as part of a collective or group than when performing as an individual.

Exert Less Effort

The phenomenon where individuals decrease the amount of effort they put into tasks, typically seen in situations involving group work or diminished personal accountability.

Q18: A model containing a linear objective function

Q31: A medium-term forecast is considered to cover

Q33: First Securities, Inc., an investment firm, has

Q50: In regression, a dependent variable is sometimes

Q57: Referring to Table 8-3, the solution to

Q63: What is wrong with Table 9-10?<br>A) The

Q81: Terms that are minimized in goal programming

Q91: The following problem type is such a

Q100: Which of the following is not one

Q105: Service level is the chance, measured in