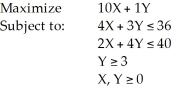

Solve the following linear programming problem using the corner point method:

Definitions:

Taxable Income

The portion of income that is subject to income tax, after deductions and exemptions.

Permanent Differences

These are differences between taxable income and accounting income that will not reverse in future periods.

Interperiod Income Tax Allocation

The process of allocating income taxes over various accounting periods because of temporary differences that cause taxable income to differ from accounting income.

Deferred Tax

An accounting concept referring to a temporary difference between the tax expense shown in the income statement and the tax payable to the tax authorities, due to timing or methodological differences in recognizing revenue and expenses.

Q13: The solution shown in Table 9-16 is<br>A)

Q16: Which of the following is true about

Q29: The adjusted r<sup>2</sup> will always increase as

Q40: In the linear programming transportation model, the

Q41: The errors in a regression model are

Q63: Which of the following is not an

Q64: Your company is considering submitting a bid

Q77: When using the EOL as a decision

Q92: Which of the following is not a

Q111: Using the data in Table 12-4, compute